- India

- International

#PanamaPapersIndia Part 3: Bellary baron, tank tycoon, top industrialist

Responses: Idea is to expand, keep creating and closing companies; it was not my money; it’s too long ago to remember now; why should I tell you?

The Panama Papers third list for Indians includes names of Satish K Modi, Ashok Malhotra, Bhaskar Rao and Sanjay Pokhriyal among others

The Panama Papers third list for Indians includes names of Satish K Modi, Ashok Malhotra, Bhaskar Rao and Sanjay Pokhriyal among others

Satish K Modi

Offshore entities: Challenge Soccer Ltd, Goldfinch Holding Group Ltd

Location: British Virgin Islands

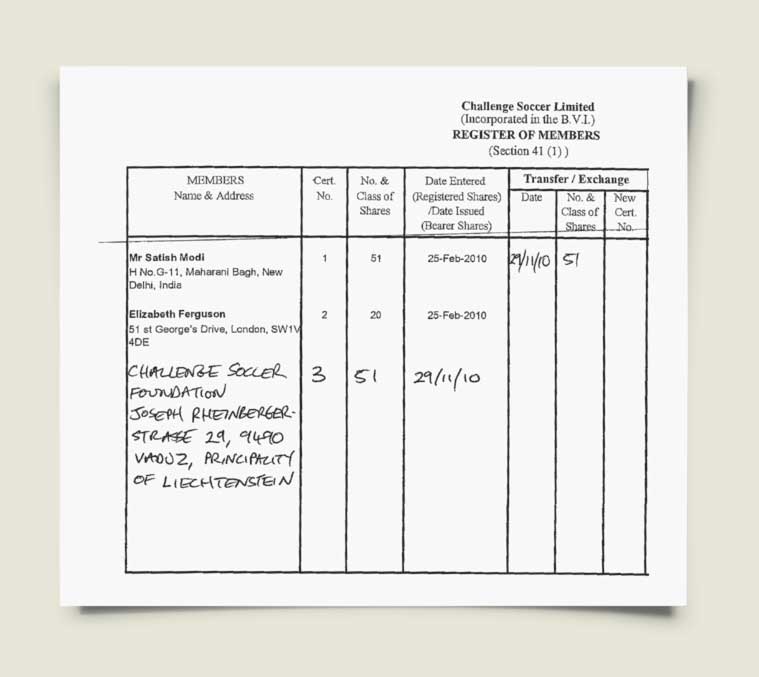

Satish Modi, 69, is chairman of Modi Global Enterprises and younger brother of KK Modi, the patriarch of the $ 1.2 billion Modi Group. He set up an offshore entity in the British Virgin Islands called Challenge Soccer Ltd in February 2010. Initially, he was a shareholder in the entity along with a UK national, Elizabeth Ferguson, before the shares were transferred to The Challenge Soccer Foundation, a foundation with a Liechtenstein address.

WATCH |Explained: What Do The Panama Papers Reveal

Modi was issued 51 shares on February 25, 2010, but these were transferred to the foundation on November 29, 2010. MF records show Modi’s India address in Maharani Bagh, New Delhi.

He continues to be a director in Challenge Soccer Ltd. Interestingly, Modi had founded a football club in the UK in 2013 known as Modi Town Football Club Limited, with its registered office in Harrow.

Modi set up Challenge Soccer Ltd in the British Virgin Islands in 2010.

Modi set up Challenge Soccer Ltd in the British Virgin Islands in 2010.

Modi is also listed as a shareholder in Goldfinch Holding Group Ltd, also registered in the BVI. His address in this company is listed as London. Goldfinch Holding was registered on August 5, 2010, and a share was issued to Satish Modi on September 21, 2010. He is the only shareholder in the company.

Panama Papers India, Part 1: Clients who knocked on a Panama door

RESPONSE: In an email sent to The Indian Express, S P Kutty, Secretary to S K Modi, said: “Please be informed that Mr Modi is an NRI for the last many years and all Indian laws have been complied with. Presently Mr Modi is abroad. We are unable to give any further information in this regard.”

—P Vaidyanathan Iyer/New Delhi

***

Moturi Srinivas Prasad

Offshore entities: Four

Location: BVI

MF records list Prasad, a prominent Hyderabad businessman, as a director in at least four offshore companies registered in the BVI in 2011. Two other local businesmen, Volam Bhaskar Rao and Bhavanasi Jaya Kumar, are listed as directors/shareholders in these firms: Yes De Ventures SA, Sika Securities Ltd, Bhasu Capitals Ltd and Bee Pee Investments Corp.

WATCH| Panama Papers: How Mossack Fonseca Helped Stash Away Billions Of Dollars

Prasad is executive chairman and managing director of Nandan Cleantec and a co-owner of Sika Securities Ltd. He is credited with setting up one of Asia’s largest biofuel processing facilities, and is associated with over a dozen other companies. He was arrested on April 2, 2012 for alleged irregularities in the export of bio-diesel, and is on bail.

READ: Ministry of Finance response to Panama Papers leak

RESPONSE: Prasad said: “These were ‘1-dollar’ companies that were started in the hope we may do some business but we did not do much. They were opened some time in 2005-06, I think. All companies are inactive now. There is no investment in them. We did not operate these companies so there was no question of declaring anything. As for the procedures and regulations, it was Volam Bhaskar Rao who was handling all that.”

— Sreenivas Janyala/Hyderabad

***

Bhavanasi Jaya Kumar

Offshore entities: Nandan Technologies Ltd, Yes de Ventures SA, Grandbay Canal Ltd, Others

Location: BVI

Hyderabad-based businessman Bhavanasi Jaya Kumar figures in the MF records as a director of some of these companies along with Srinivas Prasad and Volam Bhaskar Rao. Nandan Technologies Ltd, the records show, was opened in the BVI in 2008, and Grandbay Canal Ltd in 2015. Jaya Kumar was director of six companies associated with Nandan Technologies.

RESPONSE: Jaya Kumar said: “I have nothing to do with offshore companies like Nandan Technologies Ltd, Yes de Ventures SA or Grandbay Canal Ltd. Volam Bhaskar Rao was the managing director who handled everything. I am not aware of any offshore accounts. The original company Nandan Technologies was closed down in 2014.” On Lotus Integrated Solutions and Lucid Info, two other companies that figure in the MF list, Jaya Kumar first denied knowledge. When told that the address of both companies is his flat, No. 204 in Meenakshi Royal Court Apartments, he said they were his wife’s companies. He denied being associated with Sika Securities or Bee Pee Investments.

READ | Panama Papers: Dawood-link shadow, Iqbal Mirchi family took offshore route

On the legality of the firms, he said: “I do not know what is the status now, it has been five years. But we took all necessary permissions. I have no knowledge about declarations to tax authorities.”

— Sreenivas Janyala/Hyderabad

***

Bhaskar Rao

Offshore entities: Nandan Technologies, associated firms; Others

Rao wass MD of Nandan Technologies and six associated companies. He was also co-owner of Sika Securities Ltd, a promoter of Nandan Cleantec Limited (alternate name Nandan Biomatrix Limited), and served as MD of Nandan Cleantec Limited from April 2008. He now leads a semi-retired life, and spends a lot of time in the UK.

RESPONSE: He asked his son, Volam Sandeep, to answer on his behalf. His son said Moturi Srinivas Prasad had taken over the companies and Bhaskar Rao has since retired. “The offshore companies were set up in anticipation of doing business four years ago. But they actually became cost centres because we had to spend a lot on getting clearances and maintaining those companies…” He said the companies “are not totally closed but they are also not active”.

On declaring these offshore entities to the authorities, he said, “We followed the due procedures… we followed the rules and regulations.”

— Sreenivas Janyala/Hyderabad

***

Preetam Bothra and Sweta Gupta

Offshore entities: World Wide Group Holding Limited, Jupiter Group Holding Limited

Location: BVI

Bothra and Gupta are shareholders of World Wide Group Holding Limited and Jupiter Group Holding Limited, two companies formed in BVI in 2004. Between them, Bothra (60,000) and Gupta (40,000) hold all shares of World Wide Group Holding Limited since May 2013. Earlier, the shares were held by Jupiter Group Holding Limited (BVI) and Triansu Holdings Limited (BVI).

READ |#PanamaPapersIndia Part 2: Politician, industrialist, jeweller

In May 2013, Pradip and Kritin Bothra transferred 40,000 shares of Jupiter Group Holding Limited (BVI) to Preetam Bothra and Sweta Gupta, who got 20,000 shares each, the MF papers show. Additionally, Preetam held 15,000 shares of Jupiter (BVI) since 2004, of which he transferred 5,000 to Pradip in 2009. In all, Preetam and Sweta hold 30,000 and 20,000 shares of Jupiter (BVI). Triansu Holdings Limited (BVI) was set up in January 2005 and inactivated in October 2012. Its shareholding remains unclear.

In India, Preetam and Sweta are the directors of Jupiter Nirman Private Limited, incorporated on January 27, 2000. The company has an authorised share capital of Rs 1,000,000 and a paid up capital of Rs 265,000 and is involved in civil construction.

RESPONSE: When contacted, Sweta Gupta said: “Why should I share any such details with The Indian Express?” She subsequently did not respond to detailed queries sent as text messages.

— Aniruddha Ghosal/Kolkata

***

Bhandari Ashok Ramdayalchand

Offshore entity: Ferryden International Limited

Location: BVI

Mossack FonseCa records show Bhandari Ashok Ramdayalchand is the sole director and shareholder of a BVI company called Ferryden International Limited, which is registered with MF’s Singapore branch. The company was registered in January 2005, with Bhandari holding all its 50,000 shares.

Bhandari operates mainly out of a single-storey bungalow called “Bhandaris” in a gated community known as Abhiship Bungalows in a posh stretch of the road between Ahmedabad’s Thaltej and Shilaj localities. He provides financial services including expertise on accountancy, auditing services and investment banking to a host of companies, including some listed on the Bombay Stock Exchange.

RESPONSE: He declined to meet or speak on the phone to The Indian Express for a response. “I have informed him about your queries. He is not interested in talking about his businesses to the media. We live in this part of the town because we love a bit of privacy,” said a woman who said she was “Mrs Bhandari” but declined to give her name. The address The Indian Express tried to reach him on is the same as the one in the MF records.

— Avinash Nair/Ahmedabad

***

Ashok Malhotra

Offshore entity: E&P Onlookers Limited

Location: BVI

Living in a modest peach coloured apartment building at 35B Prince Ghulam Mohammad Shah Road, 63-year-old Ashok Malhotra is being administered medication. “I have cancer,” he says, adding,”I am very unwell, I won’t be able to talk much.”

Malhotra, who figures in the Mossack Fonseca (MF) papers, says he knows of the case. “When is it being published? Someone from The Indian Express office had called me. I won’t be able to give you details. This was years ago. I had the company E&P Onlookers Limited, but just for a couple of months. There was a middleman,” he says.

Asked what he does, Malhotra first says “offshore”, then adds mysteriously, “oil”.

But he quickly changes his story. “I was in service,” he says. “I was in sales in the Kolkata branch of a Delhi-based company. I can’t tell you the name of the company. I am retired now, and live here with my family. My son doesn’t live in Kolkata. Look at my home, does it look like the home of someone who has a lot of wealth?” he asks.

Originally from Himachal, Malhotra says he has lived in Kolkata all his life.

In a neighbouring colony, another house rented out to small-time construction company, is listed as Malhotra’s office address on listings sites on the Internet. The address is 60/112 Hari Pada Dutta Lane, and the name of the office is listed as Swift Consultants Private Limited. Landlady Devika Roy says, “Yes, Ashok Malhotra had an office here. But that was some six-seven years ago. I don’t know what they did, he never came himself. Two of his boys would come and sit here.”

— Esha Roy/Kolkata

***

Sanjay Pokhriyal

Offshore entity: Panamanian Foundation Colbury

Sanjay Pokhriyal, a printing and production specialist, appears in the MF papers as the individual who gave the initial endowment for the Panamanian foundation called Colbury. Records show that the foundation was set up in 2004, and was active until 2012. The principal beneficiaries of the foundation were Israeli nationals. Several documents show the movement of huge loans and expense money for maintaining assets and properties in places like New York. Pokhriyal, who is now 61, leads a retired life in Dehradun. His son is an engineer in Bengaluru.

READ | Rosy blue also in HSBC list: Diamond dealers are tax haven’s best friends

RESPONSE: Pokhriyal told The Indian Express that he worked with the Centurion Trust in Jersey until 2005, and the Colbury Foundation was one of the companies run by it. “Centurion Funds provided financial services for various clients based in UK, US, India and others. I did some day-to-day filing work for some companies run by Centurion but I did not work for Colbury,” he said. He said that the $10,000 endowment was not his own money, and that his name was probably used to start the Colbury Foundation.

— Devyani Onial/Dehradun

***

Prasanna V Ghotage and Vaman Kumar

Offshore entity: Nordbell Commercial Ltd

Location: BVI

Iron ore exporter Prasanna V Ghotage, 49, his wife Neha, and associate Vaman Kumar were shareholders in Nordbell Commercial Ltd, an offshore company set up in the BVI in July 2007. Ghotage’s mother Vilasini, who, according to the extended family, passed away two years ago, too was a shareholder. In 2010, Ghotage and Vilasini sold 12,000 shares to Vaman Kumar, MF records show.

Ghotage’s PVG Group operated over 3,000 trucks to transport iron ore at the height of the iron ore boom in the Bellary district of Karnataka. Vaman Kumar is an expert in the field of international trade and global commodity trade, especially iron ore.

READ | US says ‘reviewing’ Panama papers

Two other offshore entities are associated with the group, the MF papers show: Corsol Overseas SA and IRIV Holdings Limited. While Nordbell Commercial Limited is shown in the data to be a sharehoder of Corsol Overseas SA; IRIV Holdings Limited is shown to be a shareholder of Nordbell Commercial Limited.

In 2012, Ghotage, Vaman Kumar and one Manoj Dhirajlal Rajni from Goa, were accused of cheating the public sector BEML of Rs 30 crore, but the Karnataka High Court quashed the case in 2013. Ghotage was also accused of supplying poor quality iron ore by Hira Steel Ltd, a Mumbai firm. In 2015, a Goa police SIT chargesheeted Ghotage for failing to supply iron ore to a Raipur firm after taking an advance of Rs 17.5 crore. Ghotage has been in prison for a while. The Ghotages have several cases of debt recovery, wilful default, cheating, etc. against them.

Nordbell is shown in the MF papers as a Hong Kong based entity whose CEO in some trade documents is identified as Vaman Kumar. The company also had an office in Pune. “It shut down in 2010,” said a former employee of Nordbell Commercial in Pune.

“We have no contact with Prasanna Ghotage’s family or their businesses. His mother died two years ago,’’ said a member of Prasanna Ghotage’s brother Suhas Ghotage’s family, when contacted in Goa. Neither Prasanna Ghotage nor Vaman Kumar could not be contacted.

— Johnson TA/Bengaluru

***

Pradeep Kaushikray Buch

Offshore entity: Overseas Pearl Limited

Location: BVI

MF records show Buch had been a shareholder of Overseas Pearl Limited — which was registered in the BVI in 2001 — at least until 2004. His Vadodara address has been listed in the records. Nine lakh shares of Overseas Pearl Limited have been shown against his name, which were given to him after company resolutions passed in 2001 and 2003. A UAE national and another Vadodara-based businessman are also listed as the company’s shareholders. Buch lives in the Race Course Road area of Vadodara, and says he is an engineer and manager.

READ | Tracking Panama cash trail: What India Wanted, What It Got — And Didn’t

RESPONSE: “I have no overseas company. It does not belong to me. I am a professional engineer-manager. I do not know anything about companies like Overseas Pearl Limited. You may be mistaken about the address. I am basically a management consultant for companies in Dubai and Tanzania.”

— Aditi Raja/Vadodara

***

Rahul Arunprasad Patel

Offshore entity: Amarange Inc

Location: BVI

Patel is one of the three managing directors of Sintex Industries Ltd, an Ahmedabad-based company that has made a name for itself in manufacturing water tanks. He is among the promoters of the company listed on the Bombay Stock Exchange.

MF records show Patel was a director with a BVI entity named Amarange Inc which was registered in 2008. The company was struck off the MF records in 2014. The purpose for which it was set up has been recorded as: “Investments and for holding real estate in Singapore”.

RESPONSE: Contacted by The Indian Express, Rahul A Patel said: “We have a number of companies registered abroad. I am not sure if Amarange Inc is still ours. I do not deal with the financial part.”

In response to the questionnaire sent to Rahul Patel, the managing director of Sintex Industries, Amit D Patel said over the phone: “We have about 21 plants outside India. We acquired this (Amarange Inc) in 2007. While we acquire international operations, we need to create holding companies. When you acquire a company, you need to hold it outside India and then repatriate the dividends to India. So it is done with RBI permission and guidelines. We also borrow money there and we also send money outside India to fund our acquisition and we also get dividends from those companies into India. It (Amarange Inc) is part of our balance sheets and we also disclose (information about) it in our balance sheets since 2007. We keep on creating and closing these companies as and when the acquisition opportunities arise.”

— Avinash Nair/Ahmedabad

***

George Mathew

Offshore entities: Soul Rhythm International Limited, Others

Location: BVI

Thiruvananthapuram native George Mathew is a chartered accountant who moved to Singapore 12 years ago. He launched a firm, Future Books, which describes itself as a one-stop service-provider for setting up companies.

MF records show Mathew has been associated with a clutch of offshore entities registered in the BVI around 2011. He is shown as a director or nominee director, and several Powers of Attorney have been signed by him for the companies, among which there is a lot of cross-shareholding. BVI companies linked to him include Soul Rhythm International Limited, Seabridge Group Holdings Ltd, Azaxel Asset Holdings Limited, Hallwood Enterprise Ltd, and The Wonderful Solutions Corporation. MF records contain his addresses in Singapore and Kerala.

RESPONSE: Mathew told The Indian Express from Singapore that he has been an NRI for several years, and RBI regulations did not apply to him. “For the last 12 years, I have been away from India,” he said. Asked about Wonderful Solutions and Soul Rhythm International Limited, Mathew said: “These companies belong to our clients, who are natives of Singapore. The RBI and the Income-Tax Department of India have little to do with them.”

— Shaju Philip/ Thiruvananthapuram

***

Write back | Why drag me in brother’s business: Adani

Responding to The Indian Express report ‘2 months after Adani brother set up firm in Bahamas, a request to change name to Shah’, a statement released by the Adani Group stated that “the reported account holder — Mr Vinod Adani who is the elder brother of Mr Gautam Adani has been a Non-Resident Indian (NRI) for about 30 years and has his own established business interests outside India”.

“It is strange that Mr Gautam Adani’s name is mentioned in the headline though he is not the account holder and the story actually pertains to Indians having not legitimate bank accounts abroad. This is a deliberate attempt to draw Mr Gautam Adani’s name, not just to mislead the readers at large but mischievously sensationalising the matter,” it stated.

“Adani Group and the Indian resident family members of Adani family always conduct transactions within the framework of extant regulatory guidelines and provisions. We welcome the government initiatives to reach to the bottom of this matter pertaining to the black money trail including Panama leaks and assure our fullest cooperation in any kind of investigation for that matter,” it stated.

Panama Papers: A Peek Into India Express’ 8 Month Long Investigation

Apr 19: Latest News

- 01

- 02

- 03

- 04

- 05