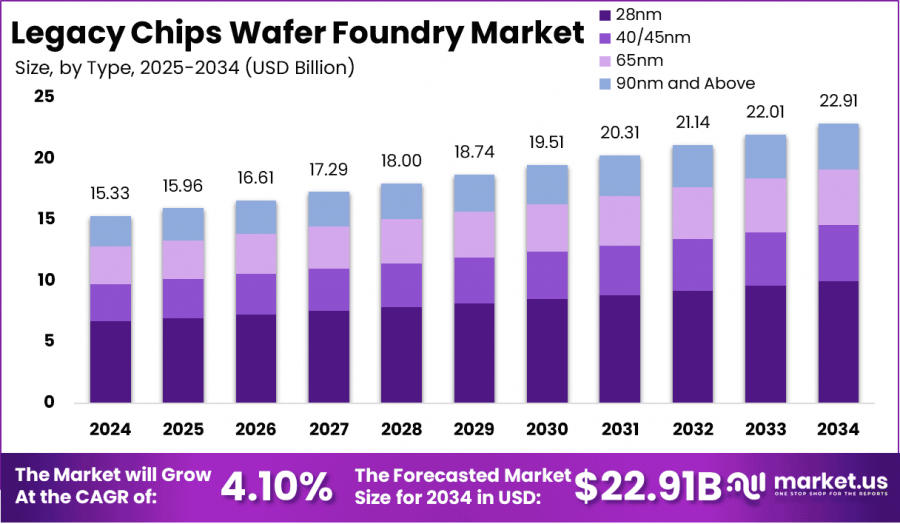

Legacy Chips Wafer Foundry Market USD 22.91 billion by 2034, CAGR of 4.10%, Region at 76.2% Market Share

By Process Node – 28nm: The 28nm process node dominates the market, accounting for 43.6% of the total market share due to its balanced performance...

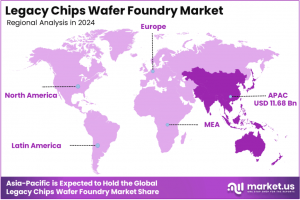

NEW YORK, NY, UNITED STATES, February 12, 2025 /EINPresswire.com/ -- The Legacy Chips Wafer Foundry Market is set to expand significantly, projected to grow from USD 15.33 billion in 2024 to USD 22.91 billion by 2034. This growth is fueled by a CAGR of 4.10% from 2025 to 2034. The Asia-Pacific region holds a commanding 76.2% share due to its robust semiconductor manufacturing infrastructure.

Legacy chips, manufactured on mature-node processes ranging from 90nm to 350nm, are crucial for industries like automotive, industrial machinery, and consumer electronics. These chips prioritize cost-effectiveness over cutting-edge performance, catering to applications where modern processing power is not strictly necessary.

🔴 𝐃𝐢𝐫𝐞𝐜𝐭 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/legacy-chips-wafer-foundry-market/free-sample/

As a result, the market benefits from established manufacturing techniques that ensure stability and reliability. The 28nm process node dominates the market, favored for its balance between performance and cost-effectiveness.

Key applications driving demand include automotive electronics, especially with the rise of advanced driver-assistance systems (ADAS) and infotainment, which require reliable, long-lasting chips. These trends highlight the ongoing and steady demand for legacy chips, even as the semiconductor industry progresses towards smaller, more advanced nodes.

Key Takeaways

Market Value Growth: From USD 15.33 billion in 2024 to USD 22.91 billion by 2034.

CAGR: 4.10% over the next decade.

By Process Node – 28nm: 43.6% of the total market share.

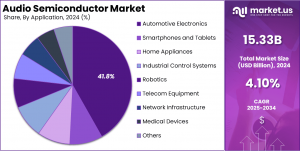

By Application – Automotive Electronics: 41.8% of the market.

Regional Dominance – Asia Pacific: 76.2% market share.

Steady Growth Potential: Driven by demand in sectors like automotive and consumer electronics.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://market.us/purchase-report/?report_id=138829

Experts Review

Experts indicate that government incentives and technological innovations significantly influence the legacy chips wafer foundry market. As nations seek independence from global supply chain vulnerabilities, governments across Asia-Pacific and North America offer incentives to boost local semiconductor manufacturing.

Technological advancements in mature-node production enhance efficiency without the capital intensity of cutting-edge manufacturing. Investment opportunities abound, particularly in emerging markets where increasing consumer electronics uptake drives demand for affordable legacy chips. However, investors should consider risks, such as potential supply chain disruptions and geopolitical tensions impacting global trade dynamics.

Consumer awareness of chip applications is rising, although legacy chips remain a backend component in industries prioritizing reliability over modern advancements. Current regulatory frameworks evolve to address concerns regarding semiconductor supply chain dependencies and quality standards.

As AI and IoT drive technological impact, foundries must balance legacy production with adapting to new technologies. Regulatory environments increasingly focus on securing semiconductor supply chains, with countries launching initiatives to mitigate dependence on specific regions.

🔴 𝐓𝐨 𝐆𝐚𝐢𝐧 𝐠𝐫𝐞𝐚𝐭𝐞𝐫 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/legacy-chips-wafer-foundry-market/free-sample/

Report Segmentation

The market is segmented by process node and application. Key process nodes include the dominant 28nm, which captures 43.6% of the market due to its favorable balance of performance and cost. Other nodes include 40/45nm, 65nm, and 90nm and above. These nodes are critical for manufacturing chips used in less performance-intensive applications.

By application, automotive electronics lead the market, representing 41.8% of demand. This sector benefits from the growing reliance on semiconductors for ADAS, in-car entertainment, and safety systems, all requiring reliable, cost-effective chips. The smartphone and tablet sector also utilize these mature-node chips for affordability, alongside industrial control systems, robotics, and telecom equipment — each relying on the efficiency and established technology of legacy nodes.

The report provides insight into regional market behavior, emphasizing Asia-Pacific’s predominant role due to its rich semiconductor infrastructure, while regions like North America contribute significantly through technological leadership and innovation efforts. Europe, facing a supply gap, highlights the need for increased local wafer production to meet regional semiconductor demands.

🔴 𝐆𝐞𝐭 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 (𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲) @ https://market.us/purchase-report/?report_id=138829

Key Market Segments

By Process Node

28nm

40/45nm

65nm

90nm and Above

By Application

Smartphones and Tablets

Home Appliances

Automotive Electronics

Industrial Control Systems

Robotics

Telecom Equipment

Network Infrastructure

Medical Devices

Others

Drivers, Restraints, Challenges, and Opportunities

The legacy chips wafer foundry market is primarily driven by cost-effectiveness. Mature-node semiconductors offer competitive advantages in industries where high performance isn't critical. Automotive electronics, industrial automation, and consumer electronics are key sectors relying on legacy chips for their affordability and reliability.

Geopolitical tensions, particularly between the U.S. and China, drive supply chain diversification efforts, encouraging investments in domestic semiconductor manufacturing. However, supply chain disruptions, as seen during the COVID-19 pandemic, present significant restraints, exposing vulnerabilities and leading to raw material shortages.

Challenges also arise from rapid technological advancements in smaller process nodes, which might shift focus away from legacy chips. Nonetheless, opportunities exist in expanding into emerging markets such as Southeast Asia and Africa, where rising disposable incomes drive demand for cost-effective electronic devices.

These markets favor legacy chips for their adequate performance and low cost. As companies diversify their supply chains and invest in stable regions, the legacy chip market enjoys robust support from diverse global resources, reinforcing its relevance in existing and new applications.

Key Player Analysis

Major players in the legacy chips wafer foundry market include TSMC, Samsung Foundry, and GlobalFoundries. TSMC remains a leader due to its extensive investment in fabrication plants worldwide, including a major facility in Arizona, which aligns with the U.S. drive for local semiconductor production. Samsung Foundry continues its dominance through strategic collaborations like its partnership with Preferred Networks for AI application chips, leveraging advanced technology even within mature nodes.

GlobalFoundries expands its footprint aggressively with new facilities like its Singapore plant, aiming to meet Asia-Pacific's rising semiconductor demand. Other significant players include United Microelectronics Corporation (UMC), SMIC, and Tower Semiconductor, all striving to balance cost-effective legacy node production with gradual technological enhancements. These companies play pivotal roles in sustaining the market's overall growth by meeting the consistent demand from various industrial sectors.

Top Key Players in the Market

TSMC

Samsung Foundry

GlobalFoundries

United Microelectronics Corporation (UMC)

SMIC

Tower Semiconductor

PSMC

VIS (Vanguard International Semiconductor)

Huahong Group

Nexchip

Other Major Players

Recent Developments

In December 2024, U.S. President Joe Biden initiated a Section 301 investigation into Chinese-manufactured legacy semiconductors, addressing national security concerns stemming from foreign dependencies. Concurrently, the U.S. Commerce Department supported local production with a $406 million grant to Taiwan’s GlobalWafers, enhancing silicon wafer production with projects in Texas and Missouri. These strategic moves reflect the U.S. commitment to securing its semiconductor supply chain amidst increasing global competitive pressures.

During the same period, TSMC announced its Arizona facility, expected to begin production in 2025, reinforcing the trend of inward investments to bolster regional semiconductor capabilities. Samsung Foundry's partnership expansions further highlighted a focus on technology leadership within diverse applications, including AI, made possible through advancements in mature-node technologies. These developments demonstrate the ongoing geopolitical and commercial realignments impacting the global semiconductor landscape.

Conclusion

The legacy chips wafer foundry market continues to thrive, driven by stable demand across various sectors needing cost-effective, reliable semiconductor solutions. With a projected steady growth pattern and substantial contributions from key regions, particularly Asia-Pacific and North America, the market remains crucial despite technological shifts towards smaller nodes.

Notably, geopolitical factors and supply chain decisions will continue to shape industry dynamics. As legacy chips sustain their relevance in automotive, industrial, and consumer electronics, strategic investments and innovations will further bolster this segment's position in the global semiconductor market.

➤ 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬

Predictive analytics in EdTech Market - https://market.us/report/predictive-analytics-in-edtech-market/

Smartphone Screen Protector Market - https://market.us/report/smartphone-screen-protector-market/

Digital Infrastructure Market - https://market.us/report/digital-infrastructure-market/

Industrial Automation Market - https://market.us/report/industrial-automation-systems-market/

Print on Demand Market - https://market.us/report/print-on-demand-market/

AI Trust, Risk and Security Management (AI TRiSM) Market - https://market.us/report/ai-trust-risk-and-security-management-ai-trism-market/

France Creator Economy Market - https://market.us/report/france-creator-economy-market/

AI in Industrial Design Market - https://market.us/report/ai-in-industrial-design-market/

AI Agents Market - https://market.us/report/ai-agents-market/

AI Toolkit Market - https://market.us/report/ai-toolkit-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release